Financial accounting system & Internal audit

Financial accounting system

Financial Management and Controlling Department of TDB has responsibilities of which elaborates and revises accounting policy of the Bank while monitoring its implementation, prepares investment plan, income and expense budget and controlling its performance, processes cost allocation for business units, provides management team with executive financial packages, cooperates with external auditors on consolidated audited financial reports for public, local and overseas customers with accurate financial information to meet their needs for decision-making.

The Department complies with Mongolian Law on Accounting, Banking Act of Mongolia, IAS, IFRS, Mongolian Law on Corporate Income Tax and other respective laws, and the guideline of banking accounting approved jointly by the President of Bank of Mongolia and Minister of Finance, and other financial reporting guidelines and procedures issued by Minister of Finance and Bank of Mongolia as well as internal accounting procedures and guidelines approved by Chief Executive Officer of TDB.

Conducting bank’s accounting and financial statements in accordance with international accounting standards enables immediate access to consolidate financial information for each banking units and its employees and provides conditions for optimal financial and economic decision-making and for positive impacts on bank’s income and expenditure savings.

Financial Management and Controlling Department consists of the units of which those are in charge of accounting, general ledger, financial analysis/statements and financial planning. The Department provides general management for Financial Accounting and Controlling Unit, Sales and Procurement Unit and conducts step-by-step monitoring as well dual monitoring on Bank’s contracts entry, audits and on daily transactions of branches and transaction centers onsite, offsite basis.

Internal audit

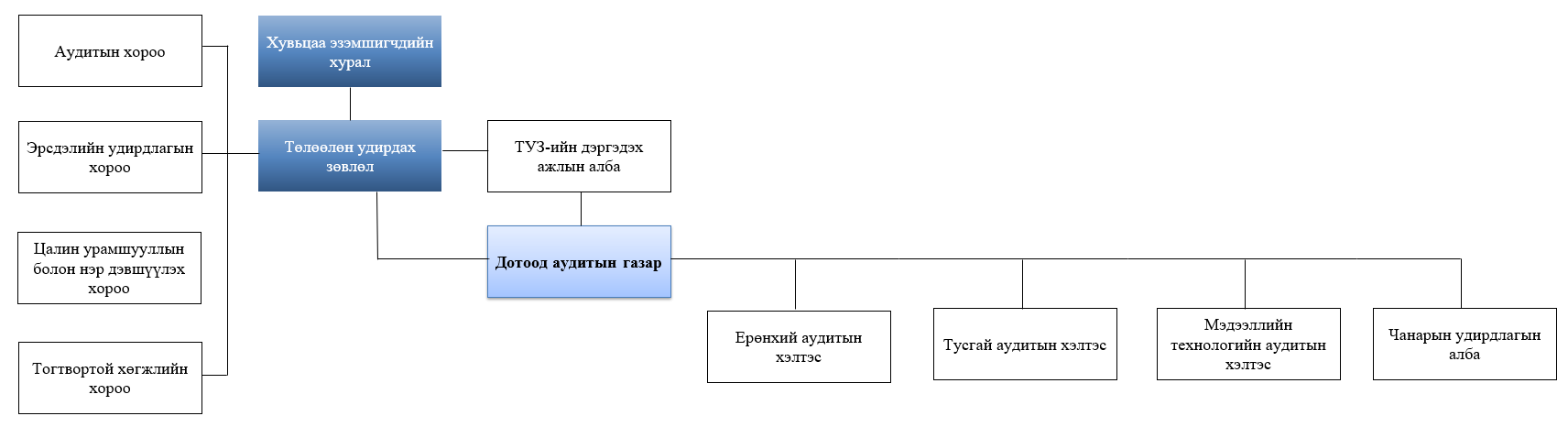

Internal Audit Department of Trade and Development Bank operates under the supervision of Board of Directors and Audit Committee and reports its operation performance.

The main purpose of the internal auditing is to assess the effectiveness of risk management and internal control system of the Bank independently and to provide an objective assurance and consulting activity designed to improve an organization’s operations and to create an additional value for the Bank itself.

The Internal Audit Department provides monitoring and evaluation on the effectiveness, optimality of risk management and internal control system, implementation of all applicable laws, policies, procedures, business ethics in the bank’s operations. In addition, the Internal Audit Department advises the Executive Directors and other respective departments, units on measures how to assess, reduce and identify potential risks, to correct non-compliance and significant errors in order to improve bank’s operations in overall. Moreover the Department reports the final result and implementation of audit guidance to the Board of Directors and executes monitoring process focused on the advancement of bank’s operations and protecting trilateral interests of bank, shareholders and customers.

Internal audit framework

Internal control is an integral part of the bank's day-to-day operations and is a system aimed at reducing risks at all levels of business and operations, aimed at providing reasonable guarantees about the effectiveness and efficiency of operations, compliance with relevant laws, and achievement of goals.

The Trade and Development Bank establishes an internal control system, which is a component of proper governance of the organization, based on relevant laws, rules, instructions, regulations, and standards.

The internal control system of the Trade and Development Bank is implemented by the Executive Management in charge of the bank's internal control, and the Audit Committee and DAG monitor its effectiveness and efficiency, evaluate, give conclusions, and improve it. For example, all units of the bank follow the "Internal Control Matrix" approved by the Executive Director's order, in addition to the regulations related to internal control in their instructions, the appropriate control duties are included in the job description of the employees, and the necessary updates and improvements are made from time to time. , with a reporting system.

The activities related to the internal control of the executive management are carried out by the Financial Management and Control Department, the Financial Registration and Control Department, the Credit Risk Department, the Risk Management Policy and Regulation Department, the Operational Risk Management Department, the Electronic Risk Management Department, the Human Resources Department, the Compliance Department, and the Legal Department. , Departments and departments of the 2nd line of defense, such as the Information Security Department, are working with integrated risk and control policies, management, methods, and methods, while the directors and senior staff of all departments, departments, and units of the bank are responsible for the products, services, and work of their respective departments, departments, and units. responsible for the performance of internal control of transactions and operations.

The Executive Management of the Trade and Development Bank regularly takes measures to optimize the internal control system of the bank, and constantly pays attention to and monitors the continuous and high-quality internal control activities. Also, the DAG conducts an audit to assess whether the Bank's internal control activities are running normally and efficiently, how the executive management is improving its internal control, and whether corrective measures are being implemented without delay. reports and takes necessary measures from time to time.